In our project we will deep dive into the innovation process and find out where on the value chain (upstream, middlestream, downstream) we find disruption potential. We seek disruption potential on value chain/value map with different motors/operators: replace, insert, consolidate or divert. Our theoretical take is based on the concepts of industry structural financial analysis, value chain concept, theory of rents (Schumpeterian, Ricardian, Penrose rent), and drivers of disruption potential, among others. A selection of innovation and disruption viewpoints:

- Bower, J. L., & Christensen, C. M. (1995). Disruptive technologies: Catching the wave. Harvard business review, 73(1), 43-53.; Hansen, M. T., & Birkinshaw, J. (2007). The innovation value chain. Harvard business review, 85(6), 121.

- Christensen, C., & Raynor, M. (2013). The innovator’s solution: Creating and sustaining successful growth. Harvard Business Review Press.

- Christensen, C. M., Kaufman, S. P., & Shih, W. C. (2008). Innovation killers: How financial tools destroy your capacity to do new things. Harvard business review, 86(1), 98-105.

- Gadiesh, O., & Gilbert, J. L. (1998). Profit pools: a fresh look at strategy. Harvard Business Review, 76(3), 139-148.

- Porter, M. E. (2001). The competitive advantage of nations. Harvard business review, 68(2), 73-93.

- Murmann, J. P., & Frenken, K. (2006). Toward a systematic framework for research on dominant designs, technological innovations, and industrial change. Research policy, 35(7), 925-952.

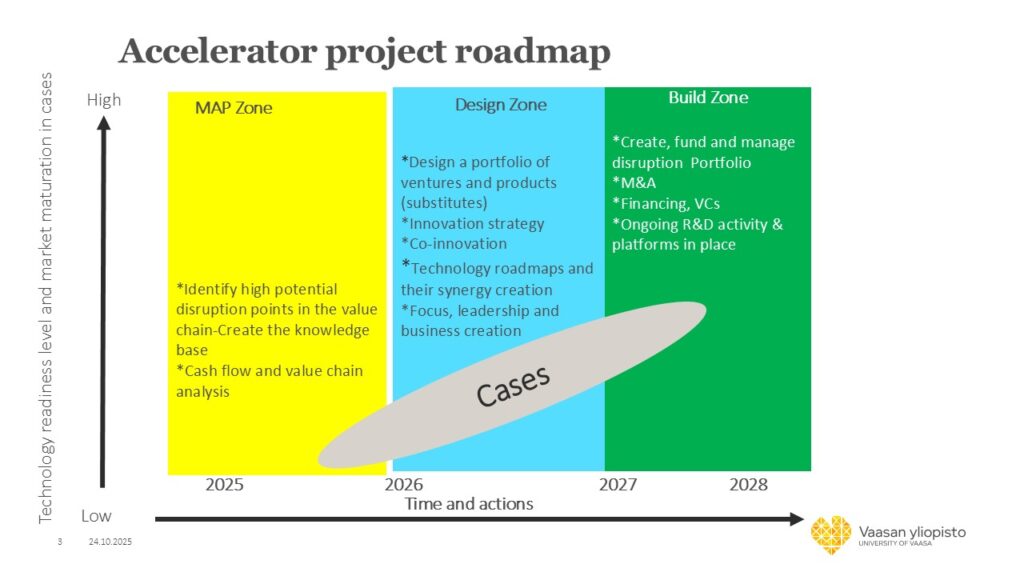

The manifestation of our project is depicted below in our Acceleration program roadmap.