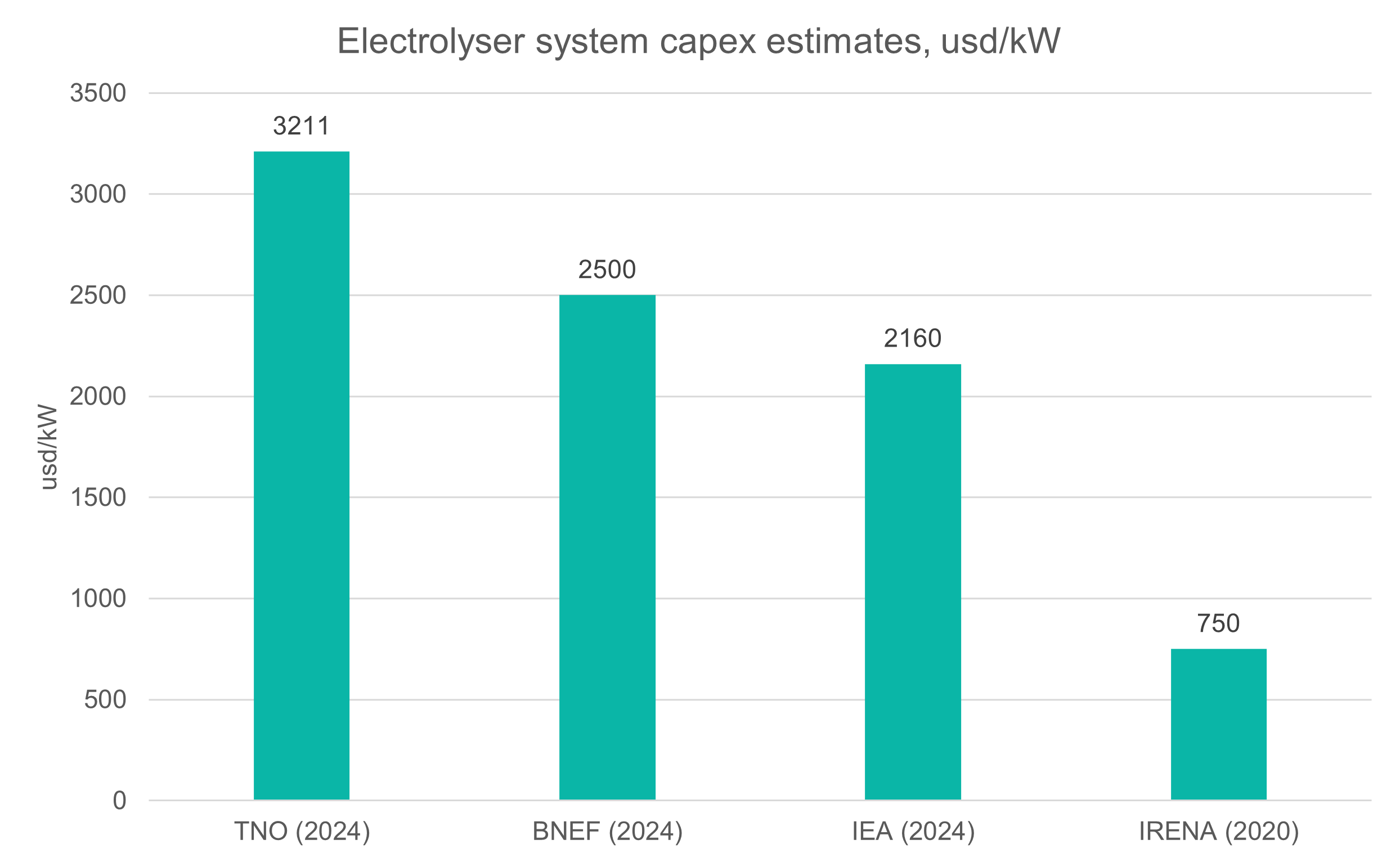

Hydrogen production investment costs are currently 3-4 times higher than what some established studies estimated in the early 2020s. The cost differential is slowing down the clean hydrogen industry progress.

Part of the hydrogen economy in South Ostrobothnia report was an analysis of the current state of the clean hydrogen production investment situation. In that analysis, the industry is evaluated based on Western market investment values. In this article we examine the underlying difference between visionary system investment value estimates and the real project data costs and what it means for the rising clean hydrogen aspirations.

An influential hydrogen system level cost assessment was made by International Renewable Energy Agency (IRENA) in their Green Hydrogen Cost Reduction- Scaling up electrolysers to meet the 1,5 C climate goal (IRENA, 2020). This study has influenced politics and research which has based on this study and other factors claimed that a price point of 2 eur/kg can be reached by 2030. In a hundred-page report IRENA claims that the electrolyser system cost was from 500-1000 usd/kW for alkaline electrolyser system and 700-1400 usd/kW for PEM (Polymer Electrolyte Membrane) electrolyser system. Their future estimate was that both technologies system cost will be less than 200 usd/kW by 2050 driving the most significant cost reduction in hydrogen production cost from 5 usd/kg to around 3 usd/kg. That is more than what they estimate that the electricity average cost from 53 usd/kWh to 20 usd/kWh will do for the clean hydrogen cost.

The reality has proven to be quite different. Current project costs based on the real project data reveal that the hydrogen system investment costs are many times higher:

- TNO (2024): 3050 eur/kW (around 3211 usd/kW)

- IEA (2024): 2160 usd/kW

- BNEF (2024): 2500 usd/kW

Average value of IRENA (2020) for alkaline system was: 750 usd/kW. A conversation rate of 0,95 has been applied for usd to eur-values.

The latest statements of the hydrogen analysis reports also paints a picture about difference what has been estimated and what is the reality.

Doyle & Krasowski (2023) mention in their Achieving affordable green hydrogen production plants report (Ramboll) based on more than 30 P2X projects that:

”From recent comparisons of +100 megawatt (MW) facilities, it became clear that there was a disconnect between forecasted cost declines in green hydrogen production and our estimates.”

ETC (Energy Transitions Commission) Chairman Adair Turner said recently:

“The cost of electrolysers have turned out far higher than we thought, and most of us have much less aggressive estimates for the fall of electrolyser costs over time”. (Martin, 2024).

BloombergNEF hydrogen head analyst, Martin Tengler voiced similar notion on the same occasion that “the electrolyser cost can be halved by 2050, but the decrease is much slower than predicted.” (Martin, 2024).

The implications of the vision and reality mismatch

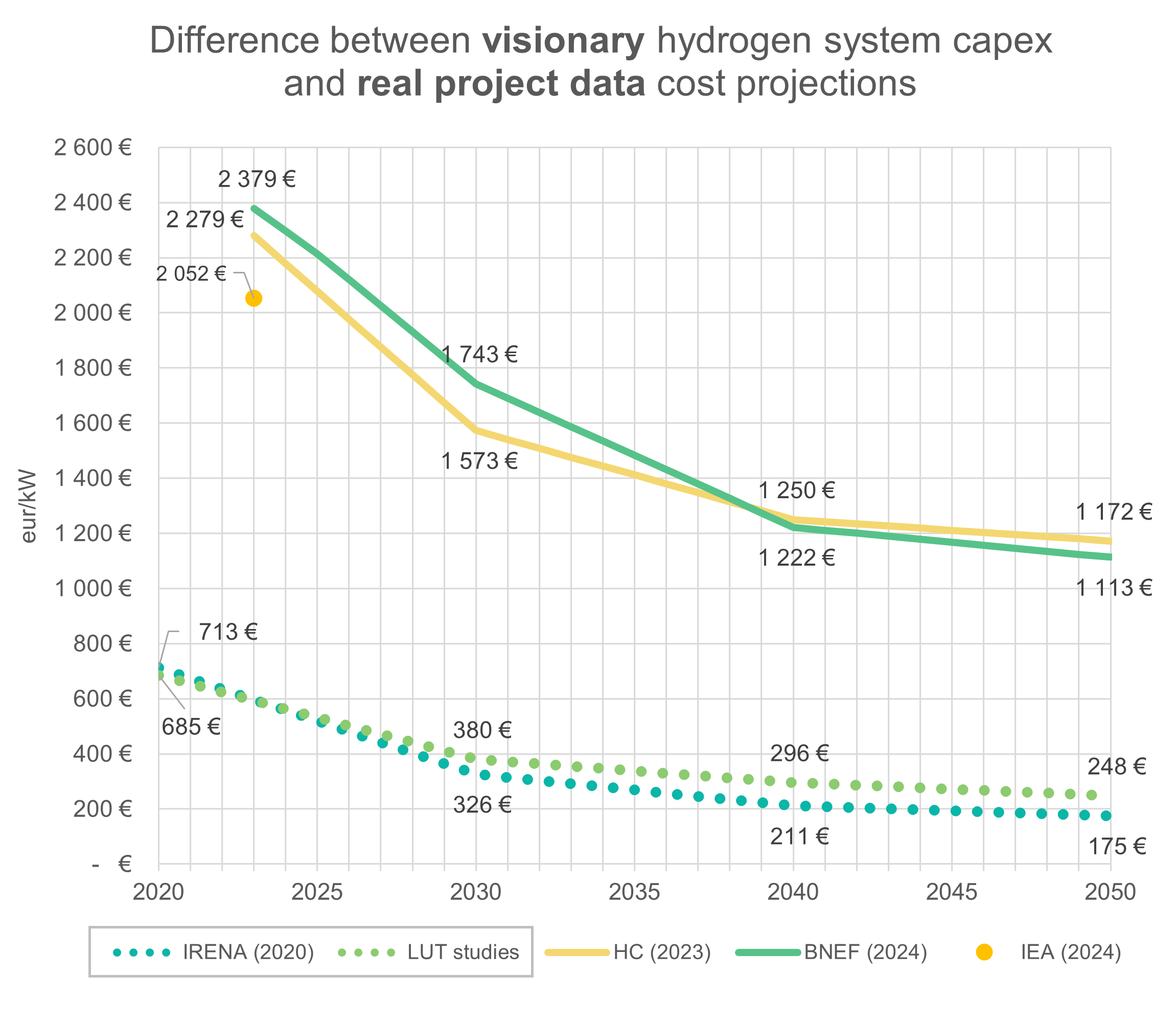

Let’s start by combining the visionary cost projections from the early 2020s with more recent estimates based on the real hydrogen projects in a same chart. In addition to BloombergNEF hydrogen investment cost estimate, chart also includes a recent Hydrogen Council and Mckinsey and company estimate for alkaline electrolyser system (2023). Their cost projection falls from today’s 2279 eur/kW to 1172 eur/kW by 2050. LUT University estimates (LUT studies) has also been included as a visionary oriented estimate in which values fall from 685 eur/kW to 248 eur/kW between 2020 and 2050. These or similar estimates has been presented by Ibáñez-Rioja et al., 2023; Galimova et al., 2023; and Fasihi et al., 2021. That’s why they are called LUT studies in this article.

A conversation rate of 0,95 has been applied for usd to eur-values.

Despite the huge difference in the current investment costs and the future projections, all of the above mentioned studies are representing the same thing: the electrolyser system cost.

In Fasihi & Breyer (2021) study, H2 compressor has been presented separately but an additional 100 eur/kW cost does not make a huge difference in closing the gap between these visionary studies and the estimates based on the real project costs. BloombergNEF latest investment cost analysis includes 52 hydrogen projects which reflects its empirical value (Tengler, 2024). The BNEF (2024) cost projection is based on Alisawi, S (2024) “Hydrogen- The end of Hype Cycle?” presentation and are visual estimation. Values are a close approximation with a error margin of +/- 20 eur/kW. IRENA (2020) estimates for 2030, 2040 and 2050 has been retrieved from Galimova et al (2023) study but the original study estimates include all the system components including the balance of plant and compressor.

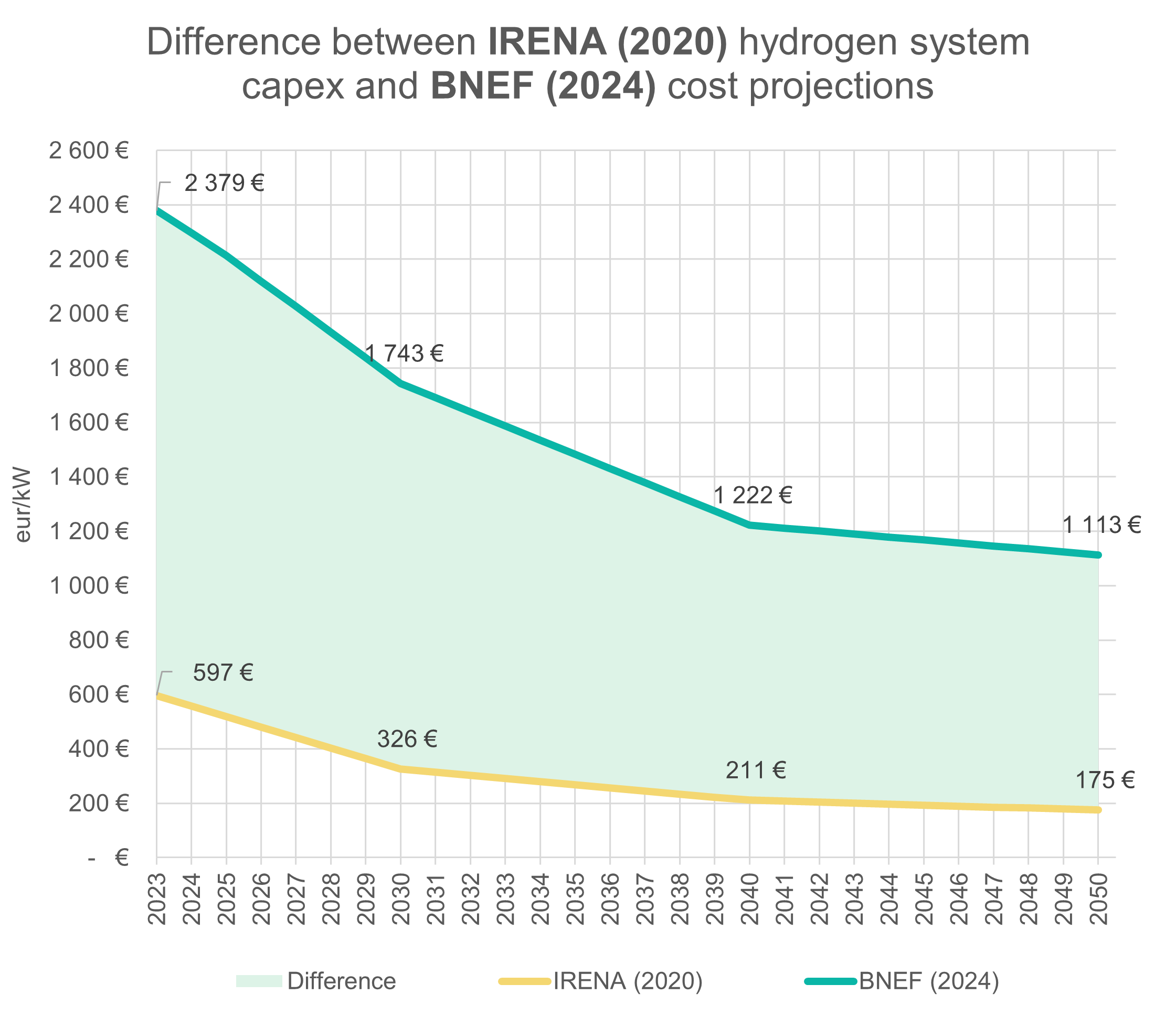

Tengler M. mentioned that BNEF estimates that the system cost will come half by 2050. That means that their system cost estimate for 2050 is two times more than IRENA estimate for the electrolyser system cost should be today.

These visionary cost estimates do not come without systemic cost to the industry which needs the clean hydrogen or to the economy as a whole. European Union has used similar visionary electrolyser cost estimates in their hydrogen policy targets which can be found from European Court of Auditors report in which they called the EU targets “overly ambitious” and calls for a reality check (ECA, 2024).

When you analyse the EU hydrogen ambition which has risen from Hydrogen strategy 2020 to RePowerEU 2022 from 40 GW of electrolyser to around 140 GW of electrolysers, the estimated investment cost increases only from 22-42 billion euros to 50-75 billion euros by 2030 (p. 46). The amount of electrolysers in the REPowerEU plan and the average of the system cost range implies that the system cost would only be around 450 eur/kW which is closely aligned with the IRENA (2020) projection between 2023 and 2030. Using the BNEF (2024) cost project total investment cost for the electrolyser systems would be around 300 billion euros which leaves us with a 225-250 billion euro investment gap between what EU predicts the system cost to be and the BNEF estimate. This is part of the reason why the around 0,5 eur/kg of public funding offered for ten years that has been made available for the hydrogen projects by the EU’s hydrogen bank has not been enough to start the green hydrogen transformation.

The difference between visionary cost projections and the real project values leaves us in a place where only the best hydrogen projects can materialize due to binding targets enforced by law. That is what we are also investigating in the Hydrogen economy in South Ostrobothnia project which is tilted towards analyzing the ecosystem and value chain after this first initial phase.

The investment cost is the second most important aspect of the clean hydrogen production cost after the electricity but needless to say that a factor of 3-4 between real and visionary investment cost is detrimental to progress that we need to see in clean hydrogen production to reach the climate targets. When applying the IRENA (2020, p. 3) system cost potential and its affect hydrogen cost estimate for the remaining BNEF (2024) system cost value, even the electrolyser system would cost more than 2 eur/kg in terms of produced hydrogen by 2050 without electricity, transportation, transformations and profit.

Clean hydrogen is needed to clean the dirty ammonium, methanol, some of the transportation and hopefully iron ore reduction, but the real production cost is much higher than was predicted only couple of years ago.

I will end this article which is calling for more realistic hydrogen investment and production cost estimates with Burchardt et al. (2023) statement from “Turning the European Green Hydrogen Dream into Reality: A Call to Action”- Boston Consulting Group analysis and their last sentence in which they call that industry should conduct factual and well-informed advocacy:

“Unrealistic claims about the cost of green hydrogen, its competitiveness, and time to scale will do the hydrogen industry, its customers, and society at large a disservice.”

Visa Siekkinen, Project Manager, Hydrogen Economy in South Ostrobothnia, SeAMK – Seinäjoki University of Applied Sciences

Acknowledgements

IRENA (2020) values has been retrieved from Galimova et al (2023) study which uses the same values.

BNEF (2024) study refers to Alisawi (2024) presentation in which the cost projection is presented up to 2050. It is in-line with the Tengler, M. statements based on the Martin (2024) article.

Alisawi (2024) and HC (2023) values has been visually estimated based on pixel analysis.

References

Alisawi, S. (2024). BNEF Talk: Hydrogen – The End of the Hype Cycle? https://vimeo.com/1018231284

Burchardt, J. ym.. (2023). Turning the European Green Hydrogen Dream into Reality: A Call to Action. Boston Consulting Group (BCG). https://media-publications.bcg.com/Turning-the-European-Green-H2-Dream-into-Reality.pdf

Doyle E., Krasowski, E. (2023). Achieving affordable green hydrogen production plants. Ramboll. https://www.ramboll.com/net-zero-explorers/what-will-it-take-to-reduce-capex-in-green-hydrogen-production

European Court of Auditors (ECA). (2024). Special report: The EU’s industrial policy on renewable hy-drogen. https://www.eca.europa.eu/ECAPublications/SR-2024-11/SR-2024-11_EN.pdf

Fasihi, M., Weiss, R., Savolainen, J., Breyer, C. (2021). Global potential of green ammonia based on hybrid PV-wind power plants. Applied Energy, 294. https://www.sciencedirect.com/science/article/pii/S0306261920315750

Galimova, T., Fasihi, M., Bogdanov, D., Breyer, C. (2023). Feasibility of green ammonia trading via pipe-lines and shipping: Cases of Europe, North Africa, and South America. Journal of Cleaner Pro-duction. 427. https://www.sciencedirect.com/science/article/pii/S095965262303370X

Ibáñez-Rioja, A., Järvinen, L, Kosonen, A., Ruuskanen, V., Hynynen, K., Ahola, J., Kauranen, P. (2023). Off-grid solar PV–wind power–battery–water electrolyzer plant: Simultaneous optimization of component capacities and system control. Applied Energy, 345. https://www.sciencedirect.com/science/article/pii/S0306261923006414

Hydrogen Council, Mckinsey & Company. (HC). (2023). Hydrogen Insights 2023 The state of the global hydrogen economy. https://hydrogencouncil.com/wp-content/uploads/2023/12/Hydrogen-Insights-Dec-2023-Update.pdf

IEA. (2024). Global Hydrogen Review 2024: Assumptions annex. International Energy Agency. https://www.iea.org/reports/global-hydrogen-review-2024

IRENA. (2020). Green Hydrogen Cost Reduction- Scaling up electrolysers to meet the 1,5 C climate goal. International Renewable Energy Agency. https://www.irena.org/-/media/Files/IRENA/Agency/Publication/2020/Dec/IRENA_Green_hydrogen_cost_2020.pdf

Martin, P. (2024). ’We overestimated how much hydrogen the world would need to reach net zero’: analysts admit. Hydrogen Insight. https://www.hydrogeninsight.com/production/we-overesti-mated-how-much-hydrogen-the-world-would-need-to-reach-net-zero-analysts-admit/2-1-1728262

Tengler, M. (2024). Electrolyzer Industry: Hydrogen Talk: Strengthening the Leadership for European Electrolyser Manufacturing. Hydrogen Europe. https://www.youtube.com/watch?v=RZe-ciKdF9ls

TNO. (2024). Evaluation of the levelised cost of hydrogen based on proposed electrolyser projects in the Netherlands. Netherlands Organisation for Applied Scientific Research. https://publica-tions.tno.nl/publication/34642511/mzKCln/TNO-2024-R10766.pdf